“After a traumatic accident, prioritizing your financial future might seem daunting. This comprehensive guide aims to empower individuals navigating the complexities of personal injuries. We’ll explore your legal rights and responsibilities, offering crucial steps for financial planning and protection. From immediate recovery strategies to long-term resilience building, this article ensures you’re prepared for every stage. By understanding your options and taking proactive measures, you can secure a stable future despite life’s unexpected challenges.”

Understanding Your Legal Rights and Responsibilities Following Personal Injuries

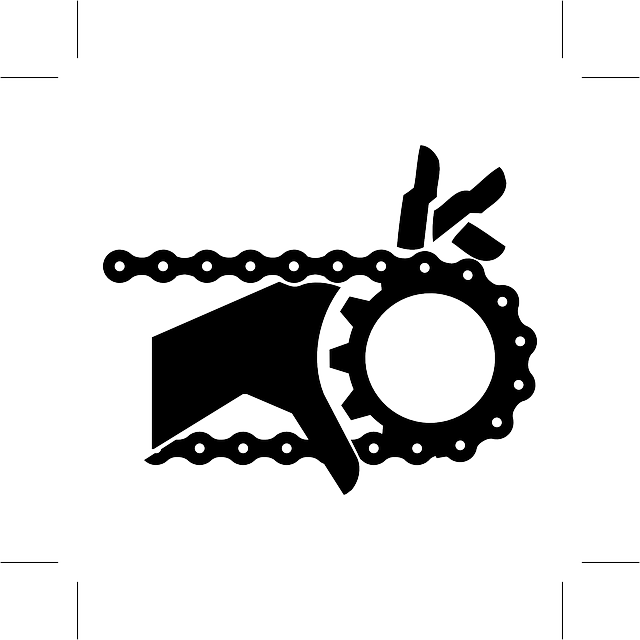

After sustaining personal injuries in an accident, it’s crucial to grasp your legal rights and responsibilities. The first step is to ensure your immediate safety and seek medical attention. Once stabilised, document all details related to the incident – exchange information with other parties involved, take photos of the scene and any visible injuries, and keep records of any conversations or communications.

Knowing your rights is essential. You may be entitled to compensation for damages such as medical expenses, lost wages, pain and suffering, and more. It’s important to understand the legal process and timeline for filing a personal injury claim, as well as the potential responsibilities you might have, like keeping records of all expenses and communicating honestly with your insurance provider. Consulting with a legal professional experienced in personal injuries can provide invaluable guidance throughout this challenging time.

Financial Planning and Protection After an Accident: Key Steps to Take

After a personal injury, focusing on financial planning and protection is crucial for securing your future. The first step is to assess your current financial situation; this includes evaluating your income, fixed expenses, and any outstanding debts. Create a detailed budget to understand your spending patterns and identify areas where you can cut costs or negotiate better terms with creditors.

Next, consider consulting with a financial advisor who specializes in personal injuries. They can help navigate the complex process of claiming compensation for medical bills, lost wages, and pain and suffering. Additionally, explore long-term financial protection through appropriate insurance policies tailored to your needs, ensuring you have adequate coverage for potential future expenses related to your injury.

Building Resilience: Long-Term Strategies for Securing Your Financial Future

After a personal injury, securing your financial future might seem like an overwhelming task. However, building resilience through proactive strategies is key to long-term stability. Start by evaluating your current financial situation and creating a detailed budget that accounts for medical expenses, lost income, and potential legal costs associated with the accident. This step provides a clear picture of short-term needs and helps you allocate resources effectively.

Diversifying your investment portfolio can also contribute to financial resilience. Consider low-risk investments like bonds or high-dividend stocks to generate steady returns while minimizing risk. Additionally, explore insurance options tailored for individuals with personal injuries, such as disability insurance or income protection plans. These measures ensure a safety net during periods of reduced mobility or income capacity, fostering financial stability and security well into the future.